Commercial Investment

Loan Products We Offer

Loan Products We Offer

GTG Capital Holdings provides customized lending solutions for those seeking long-term financing for apartments, or short-term bridge financing. Whether you’re looking to acquire or refinance a multifamily property, we have the local expertise and a customer-first focus. We offer solid execution, competitive rates, and terms and a strong relationship to build on.

In commercial real estate, mixed-use describes a property with two or more uses. A common example of this is an office building with retail on the ground floor or a commercial bakery with a retail storefront. Mixed-use property loans are available from banks, private lenders, and non-bank lenders. Purchase and refinance mortgages for stabilized mixed-use properties in the urban core can be up to 85% LTV.

GTG Capital provides commercial loans for retail properties and shopping centers, including, local or regional malls, grocery, big box, anchored, unanchored, shadow-anchored, single and multi-tenant, and similar retail property types. The tenant mix should be diverse yet complementary. Properties with restaurants, fitness centers, dry cleaners, and other similar business types may be subject to restrictive underwriting requirements. Properties, where more than 60% of the leases are rolling within the long term, are also subject to restrictive underwriting requirements.

GTG Capital’s Industrial Division offers clients property-specific and local market expertise supported by 80 years of combined experience.

Industrial warehouses continue to grow in relevance as a key component of the economic supply chain, facilitating the movement of goods from manufacturers to consumers.

Loan Products We Offer

The multifamily real estate market includes both “residential” rental property (1-4 units) and “commercial” rental property (buildings with 5+ units). Residential multifamily is the easiest to finance and has the lowest barriers to entry. This is how most multifamily investors typically get started.

A bridge loan is used to provide cash liquidity for a short period to finance investment purchases or to pay off an existing debt obligations due and payable. Bridge Loans are always much easier to qualify for, and faster to close.

Helping Small Businesses Succeed!

Down payments can be avoided for investment properties by utilizing the equity in your current portfolio!

With 100 years combined experience, we are passionate about achieving the best results for our clients.

We constantly work on delivering the best loan services to our clients. Our officer will walk you through every step of the loan application and approval process – from answering questions, to closing your loan quickly.

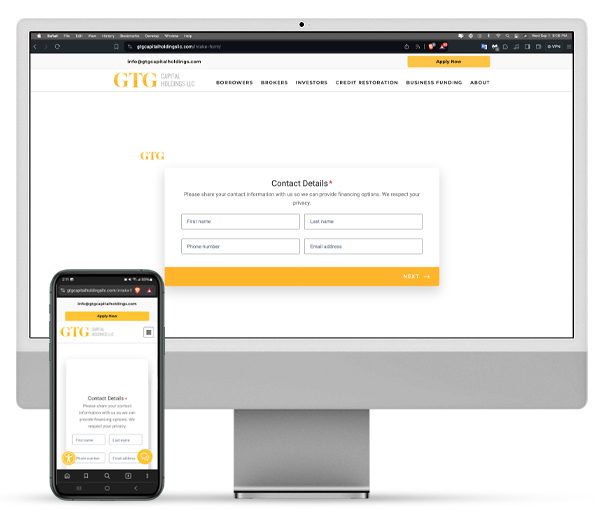

STEP 1

Choose Loan Amount

Dive into our easy to use technology to tell us about your needs and an agent will reach out shortly!

STEP 2

Get Your Loan Approved

Get all of the paperwork required to complete the purchase, including your loan documents.

STEP 3

Get Your Cash for New Home Purchase

Once all previous steps are done, you are ready to get funds and move into your new home soon!

GTG Capital Holdings was established by veteran industry experts with the strict goal of providing the best possible rates and terms available in the market. Our Christian faith plays a central role in our corporation.

“If they obey and serve Him, they shall spend their days in prosperity, and their years in pleasures.”

Job 36:11